Discretionary Portfolio Management

By embracing the diversity of investor needs, aspirations, and risk appetites, we present a trio of distinctive portfolios, enabling our clients to discover their ideal fit.

The Conservative portfolio emphasizes capital preservation, making it ideal for low-risk individuals near retirement or with a short investment horizon

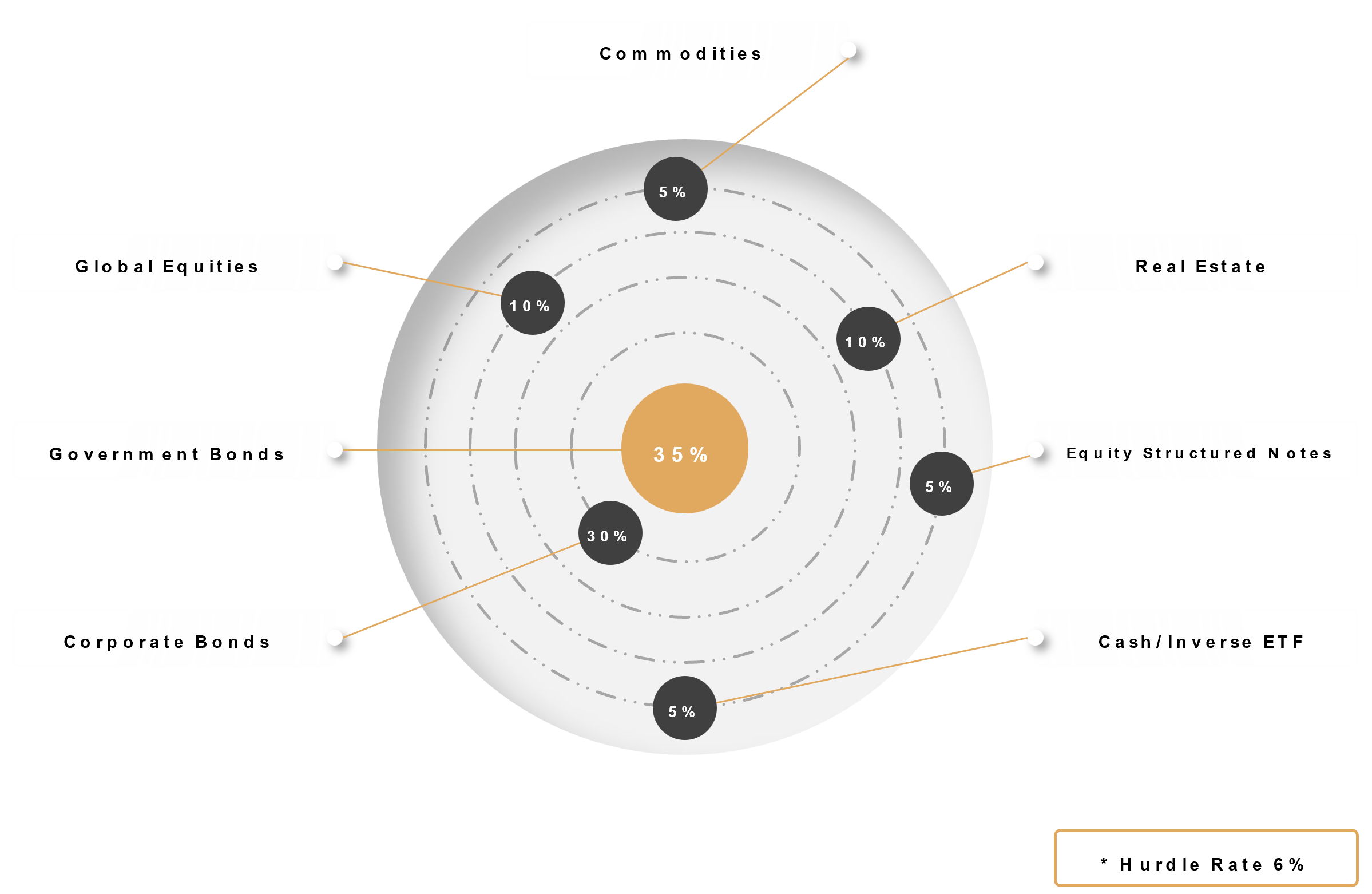

The Balanced portfolio provides stability and growth with a curated mix of bonds, cash, and stocks for moderate returns, suited for a medium-term horizon.

The Growth portfolio targets high-risk tolerance for potential high returns with more stocks, ideal for long-term investors comfortable with market volatility.

Our Approach to Portfolio Management

Diversification and strategic asset allocation

At Octave, we've mastered the art and science of risk management. By championing value in every investment, we minimize uncertainties. Our discretionary portfolio further mitigates risk by diversifying across asset classes, sectors, and regions.

A thorough vetting process

Our unwavering commitment to value drives us to rigorously evaluate every investment opportunity, from stocks and bonds to non-traditional assets, through diligent risk assessment and collaboration with top asset managers—ensuring that only the finest investment opportunities make the cut.

Professional investment advisors

Navigate the intricate world of investments with our seasoned Private Bankers and financial advisors. Armed with profound market insights and risk management strategies, they stand ready to guide you through market volatilities and opportunities alike.